The Docupace Platform

A Comprehensive, Configurable Wealth Management Software Solution for Digitizing Your Operation

The Docupace Platform simplifies the way firms process information, increasing efficiency, productivity, and profit.

Watch How Docupace Transforms Operations with Enhanced Trackability and Efficiency

We’re on a mission to eliminate paperwork.

Paper-based processes cause costly errors and delays. With powerful paperless workflows, Docupace streamlines business for home offices, advisors, and investors. Docupace is the only digital operations platform designed specifically for wealth management firms — that’s why our clients trust us to keep them efficient, productive, and compliant.

Foundations of the Platform

Our flexible and turnkey platform can be configured to leverage solutions specific to your firm’s goals and needs.

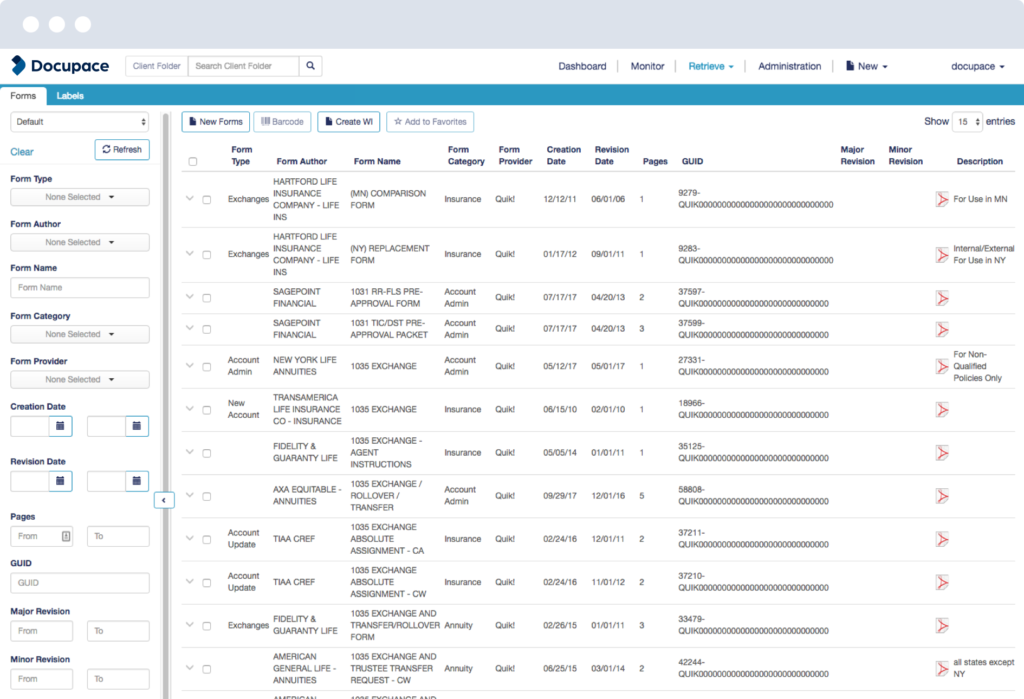

Pull the correct forms for every transaction, watch them populate automatically with client data, synchronize fields across multiple forms, and process esignatures effortlessly through best-in-breed partners like DocuSign and SIGNiX.

Key Features:

- Standard and Custom Forms Library

- Intelligent Forms Bundling

- Data Validations

- Forms Pre-population and Data Synchronization

- Embedded eSignature Digital Operations for Wealth M

Our sophisticated workflow engine makes it easy to automate your compliance and business process rules. Take advantage of easy-to-use pre-built workflows. Then, design your own workflows to increase productivity and compliance.

Key Features:

- Standardization and Data Synchronization Engine

- Intelligent Routing

- Alerts and Notifications

- Business Rules

- Configurable

Maintain SEC/FINRA compliance easily throughout many parts of your organization. Devices, Data, and Documents are secured through encryption. PII & SPI are protected from security threats.

Key Features:

- Cybersecurity

- PII and SPI Encryption

- Monitoring and Reporting

- Audit Assistance with FINRA/SEC (D3P)

- Role Based Hierarchical Access

Move seamlessly through your software ecosystem and the investment lifecycle via integrations with leading CRMs, financial planning software, data managers, e-signature platforms, clearing houses, custodians, and more.

Key Features:

- REST APIs

- Widgets

- CRM Integrations

- Portfolio Management Integrations

- Clearing and Custodian Integrations

Consolidate all of your firm’s forms and records into one organized, secure, online database that meets the demands of SEC Regulations 17a-3 and 17a-4. Access what you need, when you need it, and always be ready for an audit.

Key Features:

- Secure Storage and Collaboration

- SEC and FINRA Books and Records Compliant

- Indexing, Search and Retrieve

- Centralized and Decentralized Scanning

- Event Based Retention

Your Platform, Your Rules

Choose the solutions that suit your needs, leave the ones that don’t.

Client Onboarding

With pre-populated forms, automatic data synchronization, built-in compliance checks, and advanced integrations, Docupace makes new account opening and maintenance processes surprisingly simple.

Submit paperwork correctly the first time.

Work at the speed of paperless.

Make more time for what matters.

Document Management

Store and access your firm’s records with a secure, cloud-based document management solution. With Docupace, you can access what you need when you need it, and always be prepared for an audit.

Untether yourself from your filing cabinets or local servers.

Be your auditor’s favorite firm.

Manage books and records at minimal cost.

Advisor Transitions

What if you could give incoming advisors the ability to transition their book of business digitally in as little as 30 days? Docupace’s automated workflows, compliance knowledge, and hands-on service make it possible.

Attract great advisors.

Improve revenue.

Reduce paper costs.

RIA Productivity Suite

An advisory firm’s toolkit for digitizing, streamlining, and automating operations.

Reduce operational costs and improve efficiency.

Strengthen recruiting and attract top-tier talent.

Deliver an enhanced client experience.

Additional Solutions

Compliance TRACKR

Simplify complex client disclosure requirements with automated delivery of Form CRS (Reg BI), Form ADV and DOL Rule disclosures.

Surveillance and Compliance

Our Surveillance and Compliance solutions are the antidote to your challenges, pre- and post-trade.

Compensation Management

Create up-to-the-minute, accurate financial reports with financial summaries that can be created on an unlimited number of hierarchical levels.

Comprehensive & Configurable

Docupace does everything you need and only what you need.

We want to deliver a platform that integrates seamlessly into your existing operations and technology stack. When you work with us, a Docupace Account Manager will meet with you to develop a platform configuration tailored for your business.

Ready to digitize your operations?

Get in touch with our expert team to learn how to get started.

Ready to digitize your operations?

Get in touch with our expert team to learn how to get started.