The Modern Digital Account Opening Software for Financial Advisors

Docupace makes new account opening and maintenance processes surprisingly simple.

With pre-populated forms, automatic data synchronization, built-in compliance checks and advanced integrations, Docupace ensures you make a strong first impression that lasts.

Why Go Digital?

Docupace works the way you do — friendly, intuitive and responsive.

Clients expect fast, secure and reliable financial services. Docupace’s digital new account opening solution helps your firm meet these expectations with confidence, enhancing operational consistency and compliance to create a lasting impression. Streamline your workflows, reduce repetitive tasks and let advisors focus on advisory work over administration.

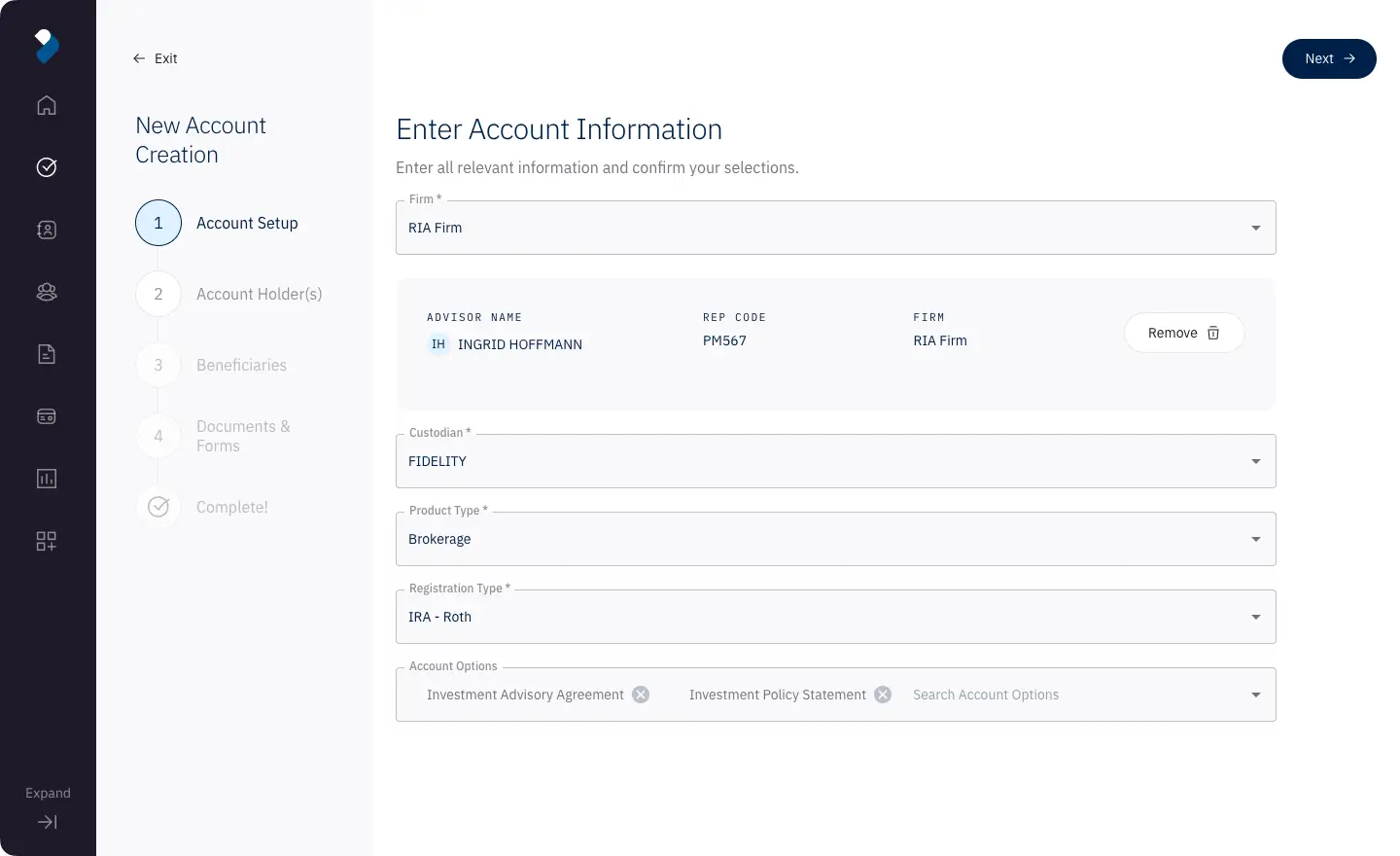

Share forms across your document ecosystem — everything you need to open an account is just clicks away. With wizard-driven forms, there’s no need for manual typing. Bi-directional data integration keeps your data live and accurate across all systems.

Eliminate Delays with Streamlined Account Opening

Today’s clients want a fast and smooth experience. Docupace’s digital account opening solution ensures quick, compliant and reliable processes for both advisors and clients, so each step moves smoothly from start to finish.

Built-In Compliance So You Can Focus on Clients

Docupace’s automated system integrates compliance checks into every step, with a digital audit trail and error-checking that reduces NIGO rates. Each submission is reviewed and error-checked, ensuring your documents are compliant and your focus remains on client service.

Not in good order? Not around here.

With Docupace, you can trust that every form is accurate and in the right sequence. Our system automatically selects the correct forms, verifies compliance and catches errors before submission, drastically reducing NIGO rates and ensuring transactions proceed without a hitch.

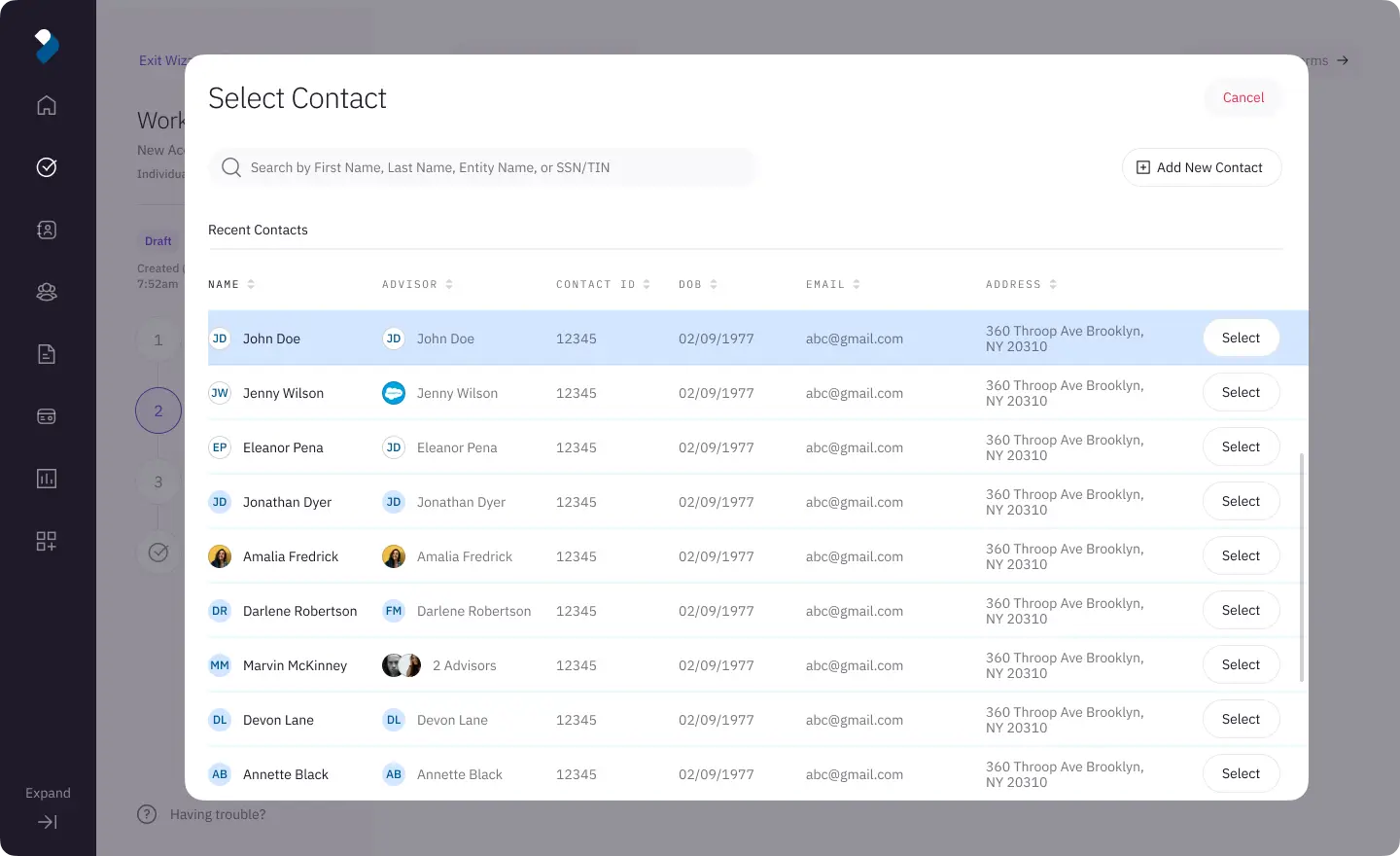

Let advisors spend more time… providing advice.

Collaborate easily with all stakeholders, track updates in real-time and communicate progress effortlessly. No more heads-down work, just streamlined processes that increase speed and improve client experience.

Time-Saving Solutions for Your Back Office

Enhance your operations with Docupace’s network of over 30 leading integration partners. From CRMs like Salesforce and Redtail to compliance and data services from Fidelity and Pershing, Docupace connects the essential tools your team relies on every day, making workflows smoother than ever. Explore how our integration ecosystem helps your back office work smarter, reducing manual tasks and ensuring reliable data at every step.

Key Benefits of Docupace’s New Account Opening Solution

Speed & Efficiency

Get clients onboarded faster with a seamless, fully digital process

Accuracy & Compliance

Reduce NIGO rates with built-in compliance checks and automated error correction

Productivity

Allow advisors to focus on clients, not paperwork, driving business growth

Tailored Benefits for Every Role in Your Organization

For Financial Firms

Optimize operations and prepare for growth with a scalable digital solution that reduces administrative burdens and improves efficiency across your back office.

For Financial Advisors

Free up time for strategic client engagement by minimizing repetitive tasks. With Docupace, advisors can focus more on advisory work, building deeper, more valuable client relationships.

For Financial Clients

Deliver a modern, hassle-free account opening experience with reduced paperwork, fewer delays and easy online access from any device, meeting client expectations from day one.

Insights for Efficient Account Opening

Explore articles, guides and success stories on improving account opening, maintaining compliance and delivering a better client experience.

Ready to Upgrade Your Account Opening Process?

See how Docupace can elevate the client experience, streamline operations and position your firm for long-term growth.